2019/10/27 星期日

AIDC日报由sdce.com.au赞助联合发布

AIDC最新资讯

BTC24小时交易量创历史新高,达到713.8亿澳元

据CMC数据,昨日随着BTC价格的暴涨,24小时交易量(713.8亿美元)也创下历史新记录。从历史数据来看,上一个记录为2019年6月27日,当时的24小时交易金额为678.6亿澳元。此外,数字货币市场24小时总交易量在近两天暴增,一度突破2289.6亿澳元,较10月初的662.5亿澳元左右增加近250%,目前数字货币市场24小时交易量为1710.6亿澳元。

(新闻来源:币世界)

谷燕西:下一个Libra会出现在东南亚

CBX研究院创始人兼院长谷燕西在微信群评论称,下一个Libra很可能会出现在东南亚。他预测,下一个Libra很可能注册在新加坡,会同样采用成员联盟形式。会员是东南亚地区合规机构,成员门槛远低于一千万美元;拥有更加符合区块链特征的、更加平等的成员,并会提供一个支持智能合约,基于POS的联盟链。联盟链会支持节点基于单一法币发行稳定币。会有多个稳定币在链上流通。同时,联盟提供类似外汇交易的稳定币兑付服务。

(新闻来源:币世界)

现场 | 陈伟星:未来数字经济时代BTC是比黄金更好的储蓄方式

10月27日,“生而极致 蜂鸟无界”蜂鸟矿机现货发售暨下一代芯片发布盛典在成都举办。泛城控股董事长陈伟星发表《POW将是唯一公链共识和万亿市场》的主题演讲,陈伟星表示,我们世界的银行体系,货币制度是有一定的问题。现在全世界在降低美元结算的能力,取代美元作为中介。黄金由于不透明容易造假不容易传递是有一定的缺陷的,在现代数字经济条件下,BTC是最好的解决方案。坚信未来数字经济时代,BTC是比黄金更好的储蓄方式。

(新闻来源:金色财经)

摩根溪创始人:一种抵制任何国家审查的货币将成为默认货币

摩根溪创始人Anthony Pompliano发推称,俄罗斯最大的石油公司俄罗斯石油公司已经停止使用美元,以避免制裁。随着美国继续将其货币武器化,越来越多的公司将继续这样做。最终,一种抵制任何国家审查的货币将成为默认货币。

(新闻来源:币世界)

Thomas Lee:随着BTC的波动 BTC收益的黄金法则也在发挥作用

Fundstrat联合创始人Thomas Lee强调了一个关键指标,该指标显示出全球最受欢迎的数字货币是如何累积收益的。Lee和他的研究团队发现,BTC在一年中的10天内就实现了大部分收益;但如果在一年中最好的10天里不持有BTC,年回报率是-25%。Lee认为,收益最大化的策略是“hodl(长期持有)”,而不是出售投资。Lee表示,10月25日(周五)似乎是BTC的“十大黄金日”之一,这一天BTC的价格飙升了30%,达到略高于1万美元的高点,BTC立即进行了修正。

(新闻来源:币世界)

GalaxyDigital首席执行官:如果美国监管机构不允许金融科技创新,中国人会吃掉我们的午餐

美国亿万富翁、数字货币投资银行Galaxy Digital首席执行官Michael Novogratz发推称:这照片是一个朋友从拉斯维加斯发给我的。如果美国监管机构不允许金融科技创新,中国人就会吃掉我们的午餐。习近平周五的讲话意义重大。数字货币和区块链将成为未来金融和消费者基础设施的一部分。购买BTC吧。

(新闻来源:币世界)

声音 | 能量链基金会主席Jason:区块链是一个不可逆的趋势和潮流

10月27日,新西兰能量链基金会产品发布会在福州数字小镇召开。会上,新西兰能量链基金会主席Jason Shen做了开场发言。Jason在发言中表示,“区块链是一个不可逆的趋势和潮流,目前仍然还处在红利阶段。未来三到五年,将会是区块链行业发展的黄金阶段。UENC技术第一阶段的任务目标已完成,UENC将抓住这个伟大的时代机遇,通过UENC让可信数据链接万物。”

(新闻来源:金色财经)

动态 | Coinbase数据:BTC最受用户欢迎 ZRX的典型持有期最长

10月26日,CryptoDiffer根据Coinbase用户数据统计前15大数字货币。Coinbase最近为其用户展示三个有趣的交易信号数据,包括Coinbase上典型持有时间和受欢迎程度。根据统计数据,BTC是最受欢迎的数字货币;而市值排名在50名之后的DAI和REP进入了前15名,CryptoRank上市值排名分别为65、64。持有时间提供了更多关于特定时间市场情绪的信息。典型持有时间是Coinbase客户在出售代币或将其发送到另一个账户或地址之前持有代币的中位时间。ZRX是持有期为135天的领先者。LTC、ETH和ETC的持有期均大于100天。而明显落后的是DAI和EOS,持有期分别为1天和4天。总体而言,这些数据为用户提供了关于市场情绪的有趣见解,并可能有助于他们建立更平衡的数字货币组合。

(新闻来源:金色财经)

Bitwise CEO:Libra可能在没有Facebook参与的情况下发布

据Live Bitcoin News报道,资产管理公司Bitwise CEO、Facebook前产品经理Hunter Horsley表示,“我确实认为Libra会推出,但我认为会在除美国以外的国家推出,在瑞士或新加坡这样的司法管辖区,而且不会被广泛使用。我认为它很有可能在没有Facebook参与的情况下发布。”Calibra 钱包可能会改为使用不同的代币,比如BTC和稳定币 USDC,甚至可能会选择美元以实现其服务于无银行账户的目标,我认为这对数字货币行业来说是个好消息。

(新闻来源:火星财经)

BTC融资案被受理,律师称BTC金融属性国内首获法院认可

近日,一起BTC质押引起的借贷纠纷已在湖北省武汉市武昌区人民法院立案,案号:(2019)鄂0106民初17932号。根据起诉书,被告质押BTC向原告借钱,赌BTC涨,在2018年BTC下跌的大周期,BTC大跌,原告采取强制平仓措施,但仍造成部分损失。被告不承认该借贷关系,构成实质性违约。该案代理律师上海申浩律师事务所孙俊律师表明:这是国内第一案,BTC金融属性在国内将会获得首次认可。

(新闻来源:火星财经)

China Passes First-Ever ‘Crypto Law’Going Into Effect January 2020

The StandingCommittee of the 13th National People's Congress in China has passed a new law regulating cryptography on Oct. 26 that will take effect on Jan. 1, 2020, reports local news outlet CCTV.

Per the report, the new regulatory framework aims to set standards for the application of cryptography and the management of passwords. The new regulatory framework establishes the role of a central cryptographic agency meant to lead public cryptographic work, creating guidelines and policies for the industry.

Implicitcryptocurrency regulation

The draft of the law was published on May 7 by a Chinese news outlet. The text is largely focused on government centralized password management and does not explicitly mention cryptocurrency, though it does focus on cryptography, a key component underpinning cryptocurrencies such as Bitcoin.

Wan explained:

“The key takeaway is — the developing of new cryptography, hashing algo, even the usage of the tech, will be in the official legal realm. This means you need to follow the CCP standard for all ‘encrypted’ behaviors, which can be VERY broad, from mining to block propagation.”

Preparing for China’s national crypto

She concluded that the law is building the foundation for the upcoming Chinese national cryptocurrency, though there is no official timetable for its launch, one Chinese official confirmed in September.

As Cointelegraph reported yesterday, China’s President Xi Jinping has called for the country to accelerate its adoption of blockchain technologies.

Meanwhile, this past week, Facebook’s Mark Zuckerberg warned that Chinese superiority in the digital currency space could put the U.S. dollar at risk in an attempt to sell lawmakers his plans for the Libra stable coin.

"China is moving quickly to launch a similar idea in the coming months. We can't sit here and assume that because America is today the leader that it will always get to be the leader if we don't innovate,” he argued in an official statement.

(News Source:Cointelegraph)

Ethereum Targets Dec. 4for Istanbul Mainnet Activation

Ethereum’s next system-wide upgrade, Istanbul, is scheduled to arrive onmainnet the week of Dec. 4.

The decision was made during an ethereum core developer call on Oct. 25. Later on Friday, Danno Ferrin, blockchain protocol engineer at ethereum venture studio ConsenSys, proposed activating Istanbul at block number 9,056,000 in accordance with the targeted date of Dec. 4.

“From when I calculated … at 14-second block times its 245,544.5 blocks, which puts noon UTC at block 9,055,928.5. So I would propose 9,056,000 as the Istanbul mainnet block target. Please check my math,” Ferrin wrote after the meeting in an ethereum core developers chat room.

During the call, devs also agreed that in the case of any unexpectedissues with the upgrade software between now and the week of Dec. 4, Istanbul’smainnet activation would be delayed one month to Jan. 8.

“The thing about the [Jan.8] backstop date is that if we’re going to ship and change the time, we have to build a new client … and get everyone to install the client,” Ferrin said during the call. “At least four weeks for are-spin is necessary.”

During the last system-wide upgrade, Constantinople, ethereum developers did indeed need to delay mainnet activation of the upgrade for a month due to acritical code vulnerability discovered just 48 hours before Constantinople’sscheduled roll-out.

This time, ethereum core developers are covering all their bases with pre-determined backstop dates in the event of any unforeseen circumstances.

Said Ethereum Foundation developer Piper Merriam:

“There’s nothing here that says [we can’t launch] the first week of December. We’re just setting some easy backstop dates now and we can always change our mind later if needed.”

What’s going into Istanbul?

Come December, Istanbul is expected to introduce six backwards-incompatible code changes to the world’s second-largest blockchain network.

The most controversial among them, known as Ethereum ImprovementProposal (EIP) 1884, will increase the computational costs of recalling data about the ethereum blockchain for application developers. At the same time, the increased fees will better safeguard the $18 billion platform from potential denial-of-service, or spam, attacks.

The other code changes introduce more pricing adjustments to the ethereum platform, as well as new code operations that application developers can leverage to verify and authenticate blockchain data more quickly.

Last month, Istanbul was activated on ethereum test network Ropsten. Due to its premature timing, however, miners on the network initially faced difficulty rolling out the upgrade.

To prevent further confusion over which version of ethereum software torun for miners (the users who validate transactions and process new blocks on the network), ethereum core developers approved today a new code change called EIP 2124.

Fork IDs and fork coordinators

Originally proposed in May by ethereum core developers Péter Szilágyiand Felix Lange, EIP 2124 introduces a mechanism for users to easily identify what version of software a computer server, also called a node, in the ethereum network is running.

“Generally, clients have a hard time following a non-majority chain so usually you have to tweak the clients [manually] … to make sure they’re on the right chain.” said Szilágyi, adding:

“All these issues can be fixed by including the fork ID.”

Called the “fork identifier,” Szilágyi explained on the call that EIP2124 is a “tiny and beyond trivial change.” It can be rolled out by anyethereum software client without the need for coordination with other actors.

Outside of this, James Hancock, project lead at ethereum startupETHSignals who most notably tried to initiate a fork of the ethereum blockchainin June, announced that he was joining the Ethereum Foundation to help coordinate ethereum system-wide upgrades, also called hard forks.

“I’m joining the [Ethereum Foundation] to help with hard fork coordination,” said Hancock. “For me, I want to focus on getting EIPs ready rather than focus on when are we going to release [an upgrade]. … It’s about changing the attitude from how many forks are we going to have this year to getting EIPs ready [for a fork].”

(News Source:Coindesk)

Bitcoin Price Explodes With One of the Biggest Rally in History

The Cryptoverse is stunned. While many analysts, traders were discussing where will bitcoin price go next - below USD 7,000 or USD 6,000 - the most popular cryptocurrency made one of its largest moves up.

In less than one day, the price skyrocketed from c. USD 7,500 to more than USD 10,100. At pixel time (05:52 UTC), it corrected lower and trades at c.USD 9,710. It's up by 30% in the past 24 hours, by 22% in the past week and by14% in the past month. Last time bitcoin price was at this level is the end ofSeptember.

Moreover, bitcoin dominance, or the percentage of the total market capitalization, jumped by c. 3 percentage points, to 67.6%. The total market capitalization increased by 24%, to USD 257.9 billion.

“This positive sentiment, along with a good buying opportunity at the key USD 7,500 support level, has led to there being more buyers than sellers —which, at the end of the day, always leads to markets going higher,” JeffDorman, chief investment officer at Arca, a Los Angeles-based asset manager that invests in cryptocurrencies, told Bloomberg.

While opinions are mixed as for what caused the rally, some analysts are attributing it to a recent news from China. China’s President Xi Jinping urged the country to accelerate the development of blockchain technology due to its importance "in the new round of technological innovation and industrial transformation" of China.

Also, on Friday, Bakkt, the U.S.-based physically-settled Bitcoin futures trading platform, set a new daily record of 1,179 Bakkt Bitcoin Futures contracts traded, or 84% more than the previous record set earlier this week.

Meanwhile, other coins from the top 10 by market capitalization are up by 7%-31%. Ethereum increased by 16%, XRP is up by 9%. However, when measuringthe returns in terms of bitcoin, only a few coins from top 100 by market capitalization are in green today. For example, ether is down by 10% againstBTC, while XRP crashed by 15.5%.

Crypto researcher and analyst Willy Woo said that, in his view, Bitcoin bull market are in 3 phases.

"A pop out of accumulation. We are still playing this out. The second phase is a nice long, steady climb with lowish volatility. (The 3rdstage is mania when volatility goes out of control). On current timelines we'll enter phase 2 a few months before the May 2020 halvening when a bullishon-chain structure should coincide with halvening front running. That's the best time to deploy capital or go long with high certainty," he said.

(News Source:Cryptonews)

AIDC今日早行情

(数据部分来源sdce.com.au)

BTC10月27日凌晨跌至13045.6澳元,后震荡上涨,现在持续在13456.0澳元附近整理。主流币跟随盘整,多数下跌。

1. 全球数字货币市场总价值为3544.7亿澳元(+3.6%),24h成交量为2054.4 亿澳元(+41.5%)。

2. 主流币表现如下:ETH暂报260.1澳元(-1.3%)、XRP暂报0.4澳元(-1.1%)、BCH暂报364.8澳元(-2.9%)、LTC暂报82.1澳元(-1.1%)、ETC暂报6.6澳元(-4.3%)、EOS暂报4.5澳元(-2.1%)。

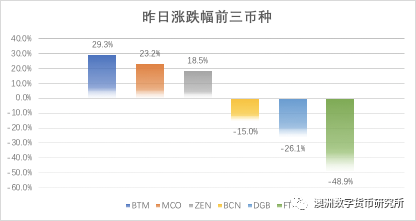

3. 24小时行情市值排名前百币种中涨幅前三为:BTM(+29.3%)、MCO(+23.2%)、ZEN(+18.5%);市值前百币种跌幅前三为:FT(-48.9%)、DGB(-26.1%)、BCN(-15.0%)。

免责声明:本行情日报作为市场公开资讯,不构成任何投资建议。(请阅读者谨慎参考)。

AIDC澳洲数字货币研究所

联合SDCE数字货币交易所

助理研究员:MaggieYU